by Jan T. Mizgajski

ESG reporting is one of the most popular topics in the corporate context these days. In 2020, 92% of S&P 500 firms released sustainability or corporate responsibility reports. From this article, you will understand ESG reporting and why it became so popular among companies. You will also learn about the newest regulations forcing companies to disclose ESG data. Last but not least, you will know how to start to report about ESG and what a well-prepared ESG report should include.

What is ESG?

ESG in business is an acronym for Environmental, Social, and Governance. These three fields, also called pillars, interest every company committed to sustainability. Companies look at their activities in terms of potential risks and opportunities in those areas. Importantly, all ESG pillars should be considered with equal attention. It’s because sustainability goes far beyond environmental issues.

The concept of ESG, as such, originates from the financial sector. Investors evaluate assets by considering Environmental, Social, and Governance factors along with financial metrics. It is called ESG investing. It’s not about doing just right but also earning a long-term return on investment.

Environmental in ESG

The environmental pillar encompasses the impact that companies’ operations have on the environment, either directly or indirectly. The aspects to be investigated under this category may include, e.g., carbon footprint, emissions to air, resource use, waste management, and impact on biodiversity and ecosystems. When considering these aspects, a company looks at its whole value chain beyond its direct operations. For instance, carbon emissions, which are generated by the company’s suppliers or final users of the company’s products, should also be considered.

Social in ESG

The social pillar encompasses a company’s impact on its social environment. It includes its relationships with its workforce, the societies in which it operates, and the political environment. At the central point of this perspective are people and their well-being. Usually, the social impact analysis applies to employees, consumers, and local communities. However, the influence of the company on society as a whole is also an essential aspect of evaluation. Similarly to the E pillar, the company’s social impact should be measured across its whole value chain.

Governance in ESG

The governance pillar refers to the company’s performance in corporate governance. This field is about the decision-making of the company’s management, executives, and board of directors. They have to ensure that their choices are made according to the company’s values while considering the balanced interest of all stakeholders. The most apparent aspect of governance to be evaluated is the company’s tax policy, executive remuneration, board diversity structure, donations, political lobbying, anticorruption behaviour, and bribery.

What is ESG Reporting?

ESG reporting means publishing information about a company’s self-assessment according to ESG criteria. The ESG reporting process measures, aggregates, and discloses ESG data. The final recipients of ESG reports are diverse company stakeholders. Most frequently, these are investment funds, governments, employees, clients or business partners.

There is no particular standard about how and what data companies should report. Companies could do it their own way or follow one of the available voluntary reporting frameworks. Currently, the most common standards are Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP), Sustainability Accounting Standards Board (SASB), Taskforce on Climate-related Financial Disclosures (TCFD), and Workforce Disclosure Initiative (WDI).

ESG and Sustainability – what’s the difference?

ESG and Sustainability are often used interchangeably. There are, however, significant differences between these terms. ESG is a framework that evaluates Environmental, Social, and Governance aspects of a business. These are lenses through which one can look at non-financial aspects of a company’s operations. Thus, ESG is more a tool than a set of principles according to which a company should operate.

On the contrary, Sustainability constitutes such principles. To be sustainable means to manage resources (social, economic, and environmental) without depleting them for future generations. The term originates from the concept of sustainable development, which is broadly defined as: “development which meets the needs of the present without compromising the ability of future generations to meet their own needs”.

ESG offers a framework for analyzing companies’ ability to incorporate sustainability principles into their operations. Therefore, by promoting the ESG perspective among companies, we can help businesses to become more sustainable.

Who is doing ESG Reporting?

Every year more companies report their ESG performance. According to Governance & Accountability Institute, 92% of S&P500 companies published sustainability reports in 2020, compared to only 20% in 2012. These companies include the most prominent global brands like Microsoft, Nike, and Apple. Companies using ESG reporting operate across a broad range of sectors, including mining exploration, energy, health sciences, industrials and technology, and are at varying stages of development.

In the EU, about 11,700 companies classified as large public-interest companies must disclose ESG reports based on The Non-Financial Reporting Directive – NFRD. This group encompasses companies with more than 500 employees with either a balance sheet total of more than 20 million euros or a net turnover of more than 40 million euros. Besides, EU Sustainable Finance Disclosure Regulation (EU SFDR), which came into effect on 10 March 2021, makes sustainability reporting mandatory for investing companies.

What are ESG regulations?

The growing number of reporting standards caused increasing concerns about the transparency of ESG metrics. Therefore, governments have begun to impose regulations to ensure more clarity about who and what should report.

In several jurisdictions, reporting ESG elements is mandatory or under active consideration. The EU is the most advanced region regarding required ESG information to be disclosed. In 2023, Corporate Sustainability Reporting Directive (CSRD) will impose a common reporting framework for non-financial data. It aims to ensure that ESG reports provide reliable and comparable information to re-orient investors towards more sustainable investment. The new regulation will affect appx. 50.000 European companies.

Other EU laws include the Taxonomy Regulation, which established specific environmental criteria related to economic activities for investment purposes. The taxonomy is a classification system defining environmentally friendly investments. However, it also requires certain entities to disclose information concerning the degree of alignment of their activities with the Taxonomy.

Why should a company report on ESG?

ESG report is not just a nice-to-have but has multiple and vital benefits for companies. So why is ESG important? Commonly experts refer to three main advantages for an organization as a result of quality ESG reporting: effectiveness, transparency, and compliance.

Effectiveness refers to indirect positive financial effects from ESG reporting. Researchers indicate a positive relationship between sustainability reporting and market performance. It is because satisfying the needs of stakeholders raises firm performance by strengthening relationships with stakeholders, promoting the firm’s reputation, enhancing legitimacy and reducing transaction costs.

Better transparency and compliance mean better risk management regarding operations and investments. Firms that engage in ESG disclosures are less exposed to litigation or negative market reaction. On the contrary, companies’ lack of ESG disclosure can result in poorly-made investments in high-risk sectors that may pollute the environment or discriminate against employees.

What kind of companies should do ESG Reporting?

In the EU, ESG reporting has become obligatory among many companies. But still, many companies, including SMEs, don’t have to comply with similar requirements. So, does it make sense for them to build ESG disclosure habits?

Definitely, even if a company is not required to report its sustainability performance by law, other stakeholders may expect it sooner or later. With growing pressure on large organizations to report their ESG impact within Scope 3, organizations need to ensure that also their suppliers comply with sustainability good practices. Therefore, tenders from larger organizations are weighing ESG responses from their supply chain. The lack of reliable sustainability data causes smaller businesses to fail at the first hurdle. Finally, also consumers and employees want to know whether a company is serious about its values, consequently deserving their attention or a long-lasting relationship.

Last but not least, the primary role of every ESG report is to deliver high-value information. None of the stakeholders needs such data more than the company itself. ESG metrics are the source of strategic information of great value for company managers. Thus, ESG reporting should be particularly of interest for fast-growing companies which want to trace their actual sustainability performance to improve themselves and rise above competitors.

How can a company report on ESG?

There is no uniform approach to ESG reporting for every company. However, many steps are similar and repeatable across different companies and sectors. The following points include best practices for almost every ESG reporting process:

- Identify ESG advocates at your company and build up a team to identify a reporting framework that provides for ESG issues, targets and initiatives, performance metrics, and internal and external reporting standards;

- Conduct a materiality assessment of your current ESG practices;

- Estimate the relative importance of sustainability issues for various stakeholders;

- Work with ESG solutions experts who can provide real-time data and advise you on your approach;

- Create an effective strategy to communicate your ESG performance to your stakeholders;

- Report your ESG data reliably and transparently.

What does the ESG report include?

ESG reporting typically includes key performance indicators (KPIs) and metrics on the issues related to the three ESG pillars. A materiality assessment should precede the exact selection of subjects. Examples of ESG topics and questions across the three pillars include:

What is your company doing to reduce its direct/indirect pressure on the environment in terms of:

- Climate change;

- Water use and conservation;

- Land use and land use change;

- Waste production and management.

What is your company doing to improve its direct/indirect social impact in terms of:

- Labour standards;

- Human rights issues;

- Employees’ well-being.

What is your company doing to improve its governance practices in terms of:

- Cybersecurity;

- Data privacy regulatory compliance;

- Tax policy;

- Executive remuneration;

- Anticorruption behaviour.

Business ESG report – example

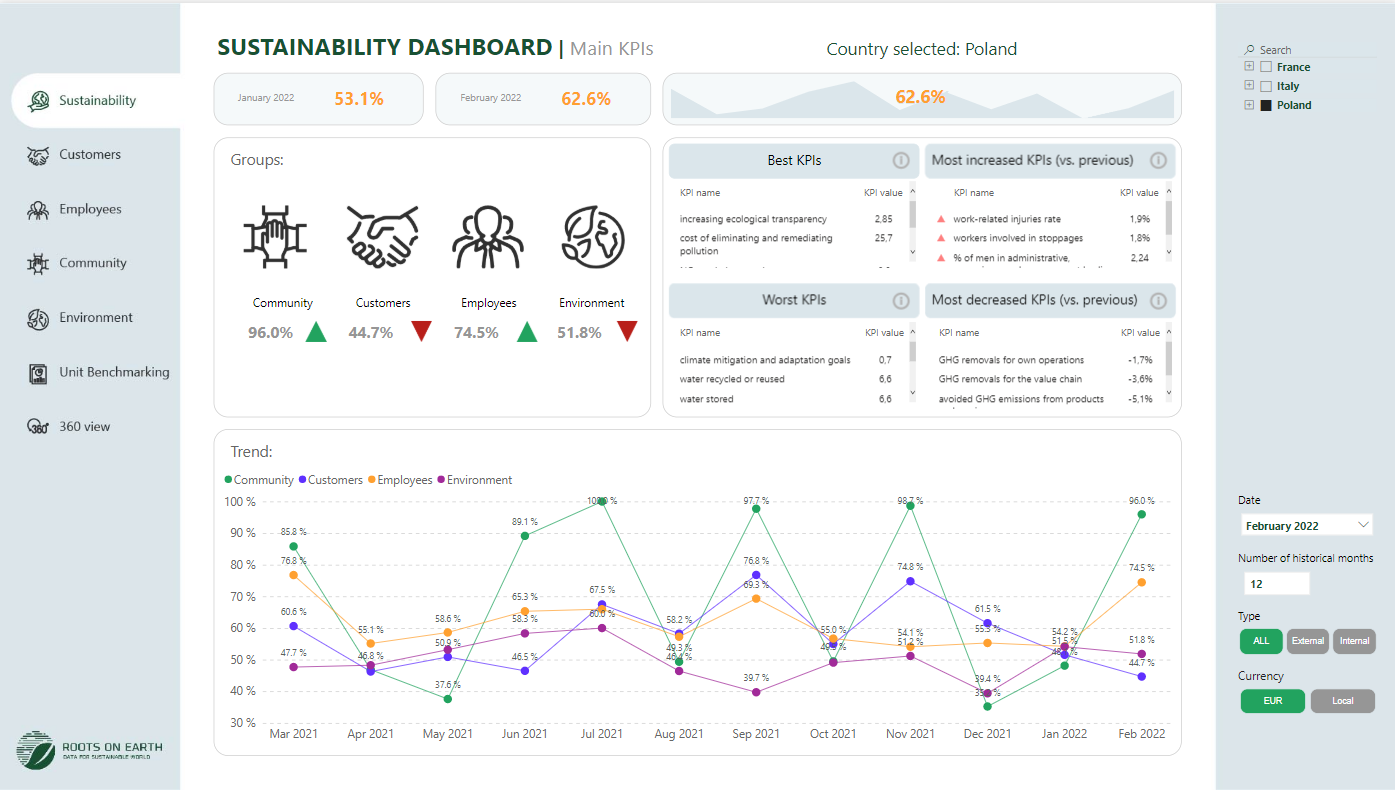

ESG reporting example is ESG Balanced Scorecard. The concept of a balanced scorecard has been widely used in strategic management. Recently it was adopted to help companies implement sustainability strategies. The ESG Balanced Scorecard combines several perspectives on sustainability dimensions, embedding community, customers, employees, and the environment. Each dimension includes objectives and performance indicators. The interactive dashboard allows for user-friendly navigation.

The ESG balanced scorecard is one of the most preferred performance management frameworks for sustainability progress tracking. Its key features are:

- quick verification of KPIs status

- easy identification of best and worst units,

- interactive monitoring

- provision of integrated information on costs/profits/environmental impact

Well designed, customized ESG Balanced Scorecard can bring quick improvements for a company through:

- reducing costs of energy, water, other resources, and waste;

- enhancing data governance to drive strategic decisions;

- increased transparency and visibility of a company.

Final thoughts

ESG importance will increase, and ESG data reporting will stay with the business for good. Financial institutions and governments share this view. There is also no doubt that more countries worldwide will strive for more regulation of business ESG disclosures. For global supply chains, this means that every company, which trades internationally, might soon be directly or indirectly forced to report on ESG.

Pro-active companies with the ambition to become branch leaders should see environmental, social and governance reporting as a chance. Researchers found that successful companies gain more significant benefits from ESG disclosures than other firms. ESG reporting gives a new perspective on business, which managers often underestimate. High-quality reports have great informative value to drive the business decision in the right direction.

The World Economic Forum identified data as the challenge No. 1 in ESG reporting. Integrating ongoing real-time ESG data is crucial for meeting sustainability commitments. Statistically, only 9% of companies actively use software for data collection, analysis and reporting on ESG. This number shows that many companies still don’t understand the enormous potential of modern technologies for sustainability reporting. Companies that realize it faster are on the way to getting a strategic advantage over competitors.

Read more:

Energizing ESG with Open Data and Power BI

What is the difference between CSR, ESG, and Sustainability

Microsoft Cloud for Sustainability and Sustainability Reporting