Have you ever wondered about the power of ESG metrics in helping companies identify risks, drive positive change, and create value for all stakeholders? Additionally, you might be interested to know about the recently adopted European Sustainability Reporting Standards (ESRS), which are poised to revolutionize ESG reporting. All the information you need is right in front of you – in this article.

Standards in ESG reporting

Several international standards have been developed, such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD) to ensure consistency, comparability, and credibility in ESG reporting.

These frameworks provide comprehensive guidance on ESG metric calculations, data disclosure, and reporting methodologies. However, the number of standards and the lack of consolidation and unification make today’s ESG world even more complicated and unclear. This situation significantly hinders ESG reporting and investment activities.

In response to expectations of a unified reporting system, the EU adopted on 31 July 2023 European Sustainability Reporting Standards (ESRS) under the Corporate Sustainability Reporting Directive (CSRD).

“The standards we have adopted today are ambitious and are an important tool underpinning the EU’s sustainable finance agenda. They strike the right balance between limiting the burden on reporting companies while at the same time enabling companies to show the efforts they are making to meet the Green Deal Agenda, and accordingly have access to sustainable finance.”- said Mairead McGuinness, Commissioner for Financial Services, Financial Stability and Capital Markets Union.

ESRS follows a “double materiality” perspective, requiring companies to report on their impacts on people and the environment and how social and environmental issues create financial risks and opportunities for the company.

The new standards also take into account the materiality assessment. In sustainability reporting, this process is critical in identifying and prioritizing ESG areas that substantially impact the organization’s sustainable practices and interest its stakeholders.

It should be stressed that materiality assessment is mandatory and crucial in ESG reporting. All disclosure requirements and data points within the standards are subject to materiality assessment. Companies must report only relevant information and may omit information unrelated to their business model and activities. However, the evaluation is subject to external assurance as per the provisions of the Accounting Directive.

For example, even if a company concludes that climate change is not material for them and doesn’t report on it, they must explain their materiality assessment’s conclusions regarding climate change. This practice is because climate change has broad and systemic economic impacts.

Moreover, introducing ESRS is also the first significant step towards a unified ESG metrics calculation system. Therefore, this article will focus on the specifics of ESG metrics reporting.

What are ESG metrics?

Recently, ESG metrics have become indispensable for organizations seeking to measure, manage, and effectively communicate their sustainability performance.

ESG metrics are measures used to assess a company’s Environmental, Social, and Governance activity. These metrics help organizations and stakeholders evaluate a company’s sustainability practices, social impact, and ethical governance. They are crucial in understanding how a company addresses critical sustainability challenges and how it aligns with responsible and ethical business practices.

ESG metrics can be classified into three broad categories, which we describe below:

- Environmental Metrics evaluate an organization’s environmental impact, including greenhouse gas emissions, water usage, waste management, and energy consumption. By measuring these factors, companies can identify opportunities for resource efficiency, emissions reductions, and sustainable practices.

- Social Metrics focus on an organization’s impact on society, including employee well-being, diversity and inclusion, community engagement, and human rights. These metrics provide insights into the organization’s commitment to fostering a positive social impact and promoting sustainable development.

- Governance Metrics assess the effectiveness of an organization’s governance structures, including board composition, executive compensation, risk management, and ethical practices. Strong governance is essential for ensuring transparency, accountability, and ethical decision-making.

These classifications are incomplete, as ESG metrics can cover various topics depending on the industry, company size, and specific sustainability goals. Additionally, multiple reporting frameworks and standards (such as ESRS, GRI, SASB, TCFD, etc.) provide more detailed guidelines for organizations to select and report on relevant ESG metrics consistently and meaningfully.

ESG metrics reporting process

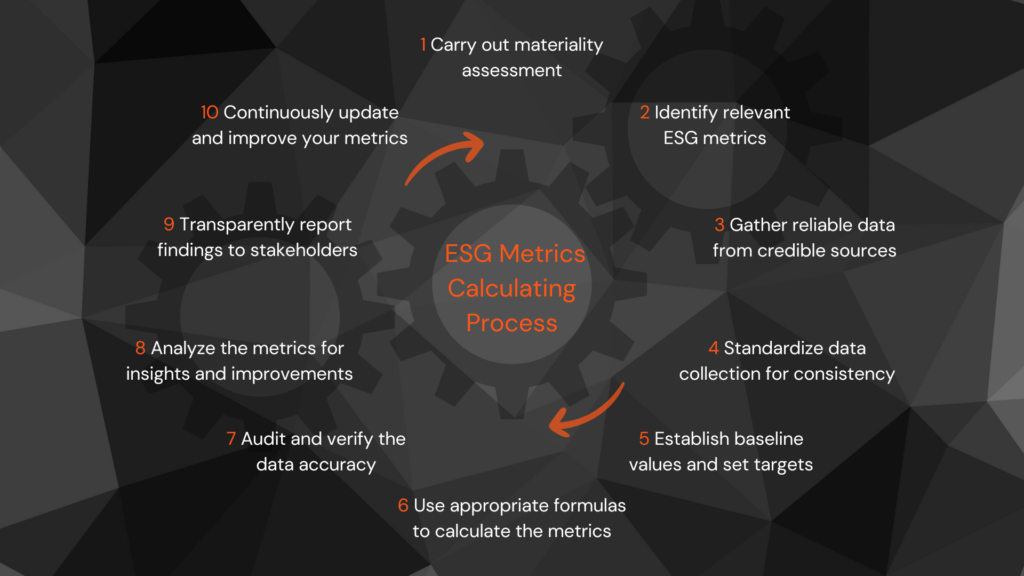

Calculating ESG metrics effectively requires a systematic approach to ensure accuracy and reliable insights. Here are the basic steps in an example process:

Following these steps, organizations can establish a robust and credible framework for calculating ESG metrics. This data-driven procedure facilitates informed decision-making, demonstrates a commitment to sustainability, and paves the way for positive change and improved sustainability performance.

Data sources for ESG metrics calculation

Gathering data for calculating ESG metrics is crucial in building a comprehensive and reliable sustainability reporting framework.

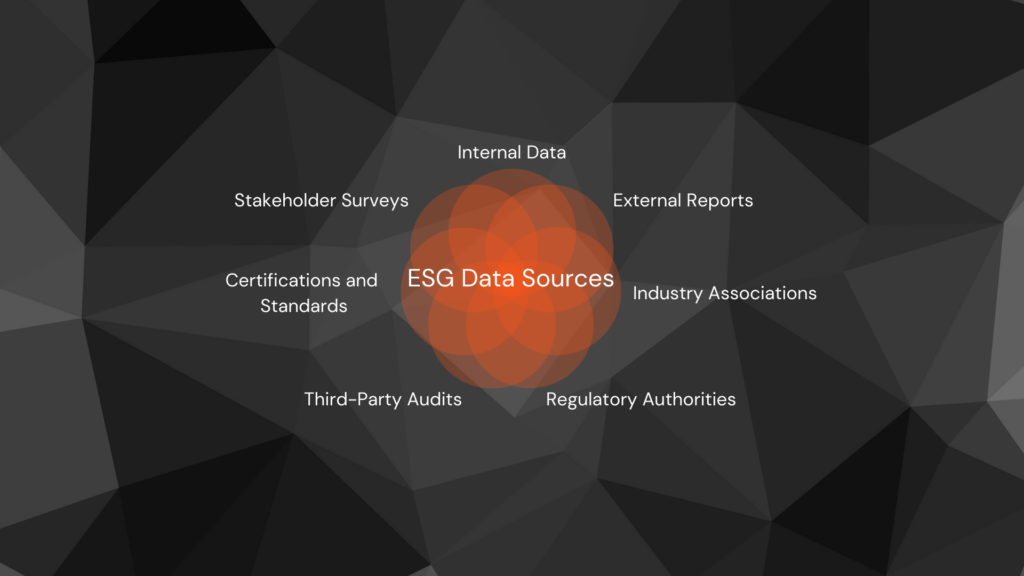

Data sources refer to the origins or places where organizations collect the necessary information to calculate ESG metrics. They can vary based on the specific ESG metric being evaluated. Here are some common data sources for ESG reporting:

Organizations must use reliable data sources to ensure the accuracy and integrity of their reporting process. Transparently documenting the data sources helps build trust and credibility with stakeholders, demonstrating a commitment to responsible and sustainable business practices.

Qualitative and Quantitative Metrics

ESG metrics fall into two main categories:

- Qualitative Metrics: Offer subjective insights, describing qualities and characteristics. They include stakeholder perceptions, employee satisfaction, brand reputation, and community impact. Measured through observations, surveys, and interviews, they provide context and understanding of an organization’s activity’s human and social aspects.

- Quantitative Metrics: Provide objective data expressed with numbers. They encompass carbon emissions, revenue, energy consumption, and financial ratios. Standardized methods offer precise and quantifiable information about an organization’s sustainability performance.

Both types are valuable, but quantitative metrics are crucial for tracking progress, comparisons, and informing responsible investment decisions. Companies that report on quantitative metrics demonstrate transparency and accountability in their sustainability practices, while qualitative metrics provide deeper insights into the company’s values and relationships.

Measurement methods

ESG metrics can be calculated using various methods depending on the specific metric and the nature of the data being measured. Here are some standard calculation methods used for different types of ESG metrics:

| Measurement Method | Description |

| Counting | Simply count discrete items or occurrences, e.g., workplace injuries, female board members, or community programs. |

| Intensity | Express ESG performance relative to a specific unit of activity, e.g., GHG emissions per revenue or water per production. |

| Percentage | Express ESG performance as a percentage of a total, e.g., renewable energy as a percentage of total energy consumption. |

| Ratio | Compare two related quantities, e.g., executive-to-employee pay ratio. |

| Weighted Average | Calculate a weighted average of multiple components based on importance, e.g., diversity score. |

| Index | Combine individual metrics into a single score, used for sustainability indices or ratings. |

| Financial Performance Impact | Tie ESG metrics to financial indicators, e.g., revenue from sustainable products or energy cost savings. |

| Benchmarking | Compare performance against industry peers or best practices to assess relative performance. |

| Life Cycle Assessment (LCA) | Analyze the entire product life cycle for environmental metrics like carbon or water footprint. |

| Scenario Analysis | Project potential ESG impacts under different scenarios, such as climate change, to understand risks and opportunities. |

It’s important to note that the calculation methods used for ESG metrics may vary based on industry-specific standards, regional regulations, and the specific objectives of the reporting organization.

Benefits for companies

Embracing ESG indicators is no longer just an option but a strategic imperative, offering myriad benefits for companies aiming to thrive in a world that values ethical, social, and environmental responsibility. In this section, we will explore the most significant advantages that ESG indicators adoption brings:

- Compliance and Reduced Legal Risks: ESG reporting isn’t just good practice; it’s the law. Companies demonstrating compliance by staying on top of ESG metrics reduce legal risks.

- Attracting Responsible Investors: ESG-focused efforts and transparent reporting attract responsible investors seeking long-term partnerships. They allow investors and analysts to gauge a company’s ESG score, ranking, and risk profile (beneficial for benchmarking with companies from the same sector).

- Risk Management and Resilience: Proactively identifying and managing ESG risks makes businesses more resilient and better prepared for challenges.

- Cost Savings and Efficiency: ESG analysis reveals resource optimization opportunities, resulting in cost savings and better efficiency.

- Engagement with Stakeholders: Transparent ESG reporting fosters trust among employees, customers, suppliers, and regulators. Strong relationships enhance support and cooperation for shared objectives.

- Enhanced Reputation and Trust: Prioritizing ESG metrics bolsters a positive brand reputation. Trust and loyalty from customers increase as they see your commitment to social and environmental responsibility.

The above list only exhausts the topic of benefits that the company will gain thanks to the reporting of indicators. However, it presents critical points from the perspective of building a strategy. On the one hand, the company operates under law regulations. On the other, it creates its position and competitive advantage by enhancing its reputation, attracting investors, improving risk resilience, and contributing to a sustainable and prosperous future.

Trends and challenges

As the importance of ESG metrics continues to grow, several trends and challenges have emerged. One notable trend is the inclusion of Scope 3 emissions, which account for indirect emissions associated with a company’s value chain. Integrating Scope 3 emissions into ESG metrics provides a more holistic view of an organization’s environmental impact, but it also adds to our calculations a lot of new data sources. According to the data from 2021, Scope 3 accounts for over 70% of the whole company’s emissions, creating a carbon footprint. That is why including it in our calculations makes them much harder and more complicated.

Challenges include the need for substantial data collection and analysis. Organizations must harness the power of their IT departments to gather, manage, and interpret vast amounts of data to calculate ESG metrics accurately. However, these challenges can be overcome by collaborating with ESG experts with the knowledge and technical capabilities to streamline the process.

ESG metrics reporting relies on various technologies to collect, analyze, and present data effectively. The importance of each technology may vary depending on the organization’s size, the data’s complexity, and the reporting requirements.

The chart below shows some essential IT technologies that play crucial roles in ESG metrics reporting:

It’s important to note that selecting specific technologies depends on factors such as the organization’s ESG reporting goals, data complexity, available resources, and the level of sophistication required. Some organizations may implement a comprehensive ESG reporting system, while others may start with basic tools and evolve their capabilities over time.

Conclusion

In conclusion, the strategic use of ESG metrics offers numerous benefits to companies striving for sustainable growth and responsible practices. By diligently ESG reporting under applicable standards, organizations can achieve advantages such as law compliance, improved risk management, attracting responsible investors, building positive brand reputation, cost savings, and more.

As the importance of ESG continues to grow, companies face trends and challenges that include incorporating data from suppliers and end-users (e.g. Scope 3 emissions) in ESG metrics. This task needs sophisticated data collection and analysis capabilities. Overcoming these challenges requires collaboration with ESG experts who possess the technical know-how and the IT specialists who play a vital role in gathering large amounts of data and facilitating complex calculations.

At Clouds on Mars, we recognize the intricacies and significance of ESG metrics. Our ESG and IT experts are ready to support organizations in various aspects, including data gathering, developing calculation models, preparing comprehensive reports adhering to international standards, and conducting ESG metric calculations. We offer tailored solutions to help clients efficiently achieve their sustainability goals.

If you want to deep dive into our ESG solutions or just need help understanding the ESG impact on your business and how the above tools could be adjusted to your demands do not hesitate to contact our ESG team at ESG@cloudsonmars.com

Read more about ESG Reporting on our blog:

Innovations in ESG reporting – Part 1

Microsoft Cloud for Sustainability and Sustainability Reporting

ESG Reporting – Why is it so important to companies?